Acquisitions

As a result of our active focus on the acquisition of new properties, we were able to make 11 high-quality acquisitions in 2019. Investments totalled around €422 million in 2019, some €223 million above plan. We acquired a total of 1,192 homes (1,041 apartments and 151 family homes). All but two of the acquired properties have an energy index on or below 0.2 and all acquired properties have a minimal GPR score above 7.5.

Apart from the purchase price, market vendors appreciate matters such as reliability, vigour and expertise. It is also very important to stand out in terms of deal security, efficiency, rapid (legal) structuring and decision making. All these aspects played a role in achieving these results. The Fund financed the acquisitions from existing commitments, the commitments of new shareholders, top-up commitments from existing shareholders and through divestments. All of the acquisition properties are located in the Fund’s core regions, with 788 homes located in the Randstad:

1,041 apartments

151 family homes

641 affordable homes

€ 422 million investment volume

The assets we acquired in 2019 are shown below.

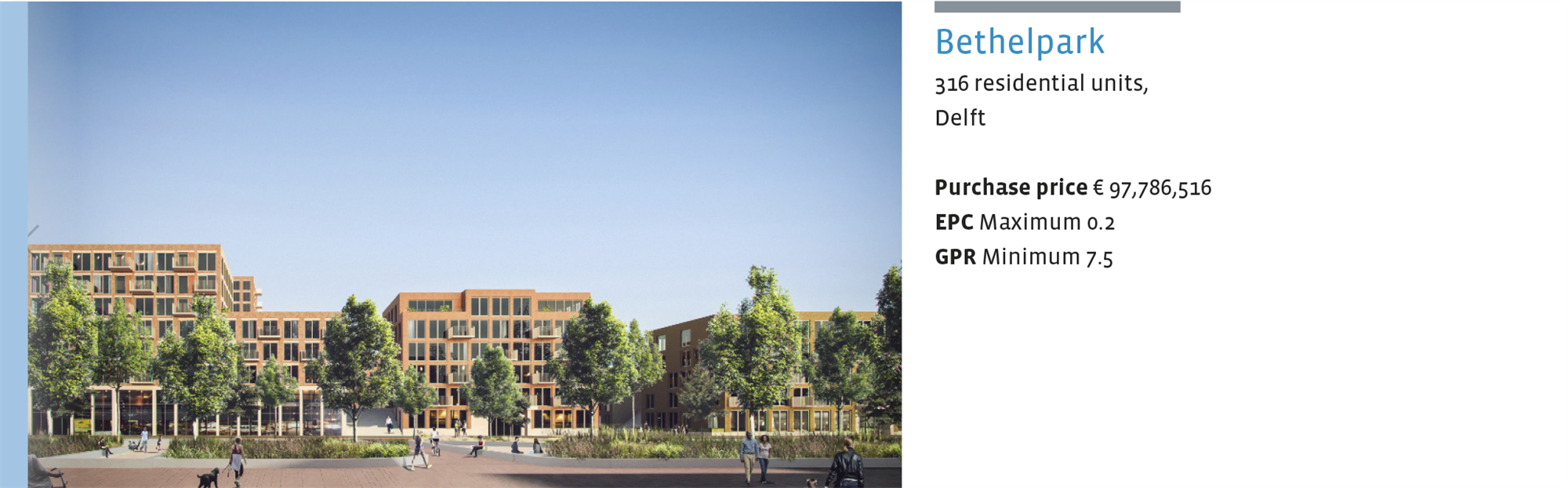

Bethelpark, Delft

Expected rental bandwidth € 720 - € 1,540 (price level 2022)

The Bethelpark project on Reinier de Graafweg in Delft is located south-west of the centre of Delft. The projects covers 302 apartments (with 235 of these mid-rental segment homes and 18 social housing homes) varying in size from 52 m² to 85 m², as well as 14 town houses measuring 122 m². The development is located next to the Reinier de Graaf Gasthuis hospital and has ample amenities nearby, with various schools and De Hoven shopping centre within walking distance. Delivery is scheduled for 2021.

De Wateringen, Den Haag

Expected rental bandwidth € 931 - € 1,503 (price level 2020)

The De Wateringen project on Guido van Dethstraat in The Hague is located on the outskirts of the neighbourhood Wateringseveld, with various amenities nearby. The project also has a highly sustainable energy system. The project offers a high-quality alternative to the somewhat outdated housing stock in the neighbourhood. The project comprises 30 apartments, with 18 of these in the mid-rental segment. The homes vary in size from 68 m² to 127 m². Delivery is scheduled for 2020.

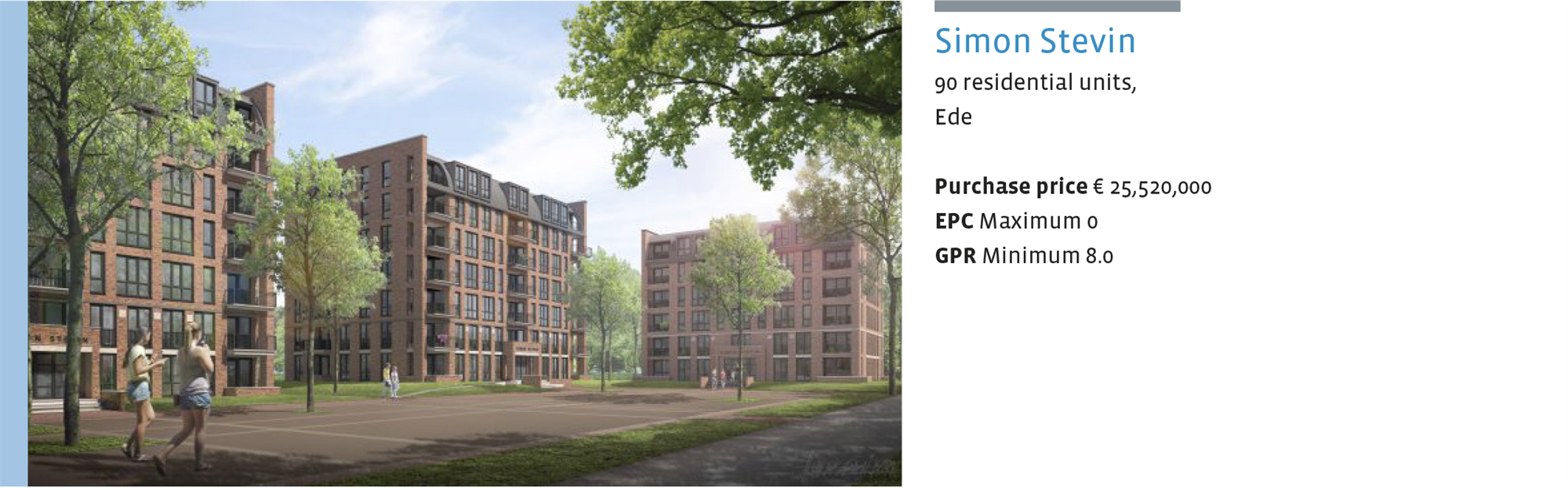

Simon Stevin, Ede

Expected rental bandwidth € 919 - € 1,419 (price level 2021)

The Simon Stevin project is located on the site of the former military barracks on the eastern side of Ede and comprises 90 liberalised sector rental apartments, with 58 of these designated as mid-rental apartments. The apartments are located in three virtually identical buildings around the former exercise area. The homes vary in size from 83 m² to 133 m². The former barracks are located on the eastern side of the city centre, with amenities within walking and cycling distance. Delivery is scheduled for 2021.

Licht & Lucht, Zeist

Expected rental bandwidth € 830 - € 1,395 (price level 2022)

The Licht & Lucht project is in the conveniently located Kerckebosch neighbourhood on the south-eastern side of Zeist and is easily accessible by both public transport and by car or bike. The project comprises 48 apartments, divided across two building with a semi-underground parking area with 60 parking spaces. Of the 48 homes, 44 are designated as mid-rental homes. The homes vary in size from 53 m² to 99 m². Amenities such as the neighbourhood shopping centre, school and other facilities are within walking distance. Delivery is scheduled for 2021.

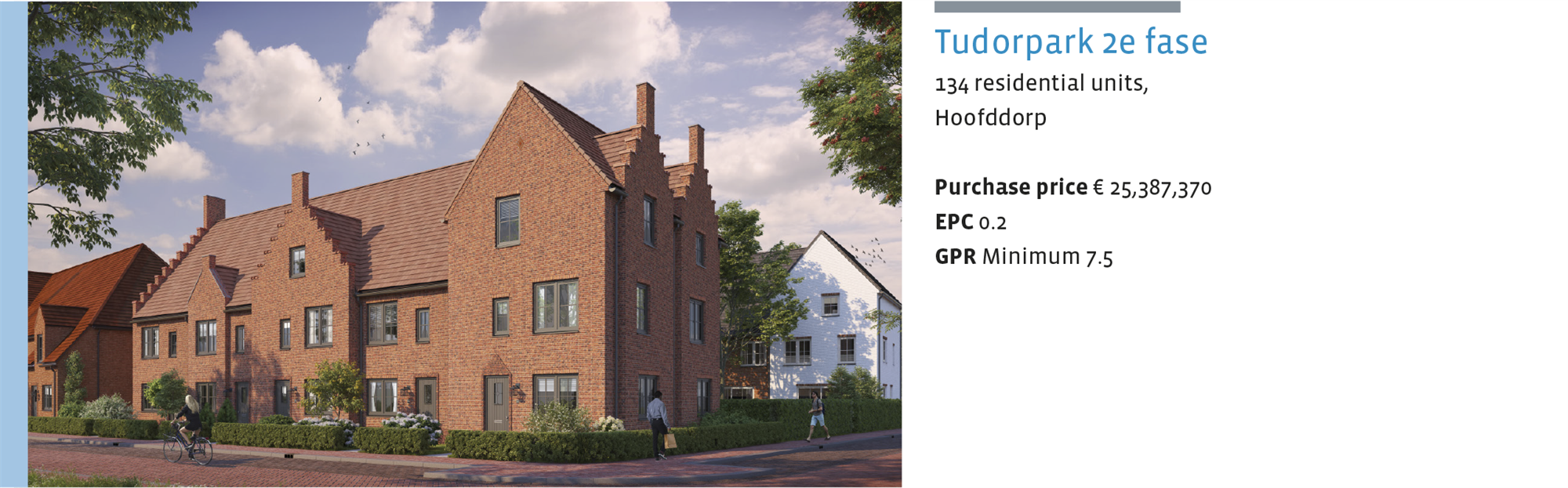

Tudorpark 2nd phase, Hoofddorp

Expected rental bandwidth € 1,373 - € 1,553 (price level 2021)

The second phase of the Tudorpark project is located in the new-build neighbourhood Tudorpark on the southern side of Hoofddorp. The 62 family homes, varying in size from 124 m² to 145 m², are set in a villa park setting and are extremely varied in terms of design and size. The new neighbourhood has a distinctive appearance due to the use of classic architecture (English Tudor style). All amenities, such as shops and school, are nearby. The neighbourhood is immediately adjacent to a large recreational lake (Toolburgerplas) and the nature area Park21, which is currently being developed. Delivery is scheduled for 2020.

Buitenpoort Parkwachter, Rijswijk

Expected rental bandwidth € 1,029 - € 1,125 (price level 2022)

The Buitenpoort Parkwachter building is located in the Rijswijk Buiten residential area: a sustainable neighbourhood with a total of around 3,500 homes, around 1,000 of which have already been realised. The project comprises 40 three-room apartments varying in size from 64 m² to 76 m². The central location between Rijswijk, The Hague, Delft and Rotterdam makes this an attractive location for commuters. Residents have access to a shopping centre, various junior schools, city parks and sports facilities within 1.5 kilometres. Delivery is scheduled for 2021.

Stadshagen Breezicht, Zwolle

Expected rental bandwidth € 1,022 - € 1,083 (price level 2021)

The Breezicht project is located in two sections of the new Breezicht neighbourhood in the Stadshagen district of Zwolle and comprises 75 so-called zero-on-the-meter (NOM) family homes of 116 m². The essence of Breezicht is rural living in the midst of an open landscape. Living in nature in a sustainable environment is key in the concept. The Breezicht neighbourhood is located to the west of the Milligerplas lake in the Stadshagen district, cycling distance from sports fields, schools and the Stadshagen shopping centre. Delivery is scheduled for 2020.

Kop van West Veld F, Purmerend

Expected rental bandwidth € 814 - € 1,198 (price level 2022)

The Open Vest project in Purmerend is situated in an attractive location in the ‘Kop van West’ new-build neighbourhood, on the canal close to the town’s historical centre and the bus station. The project comprises a closed building block of 115 apartments varying in size from 49 m² to 94 m², 157 m² GLA of commercial space and 81 parking spaces divided across various blocks, all built around a shared courtyard garden. Delivery is scheduled for 2022.

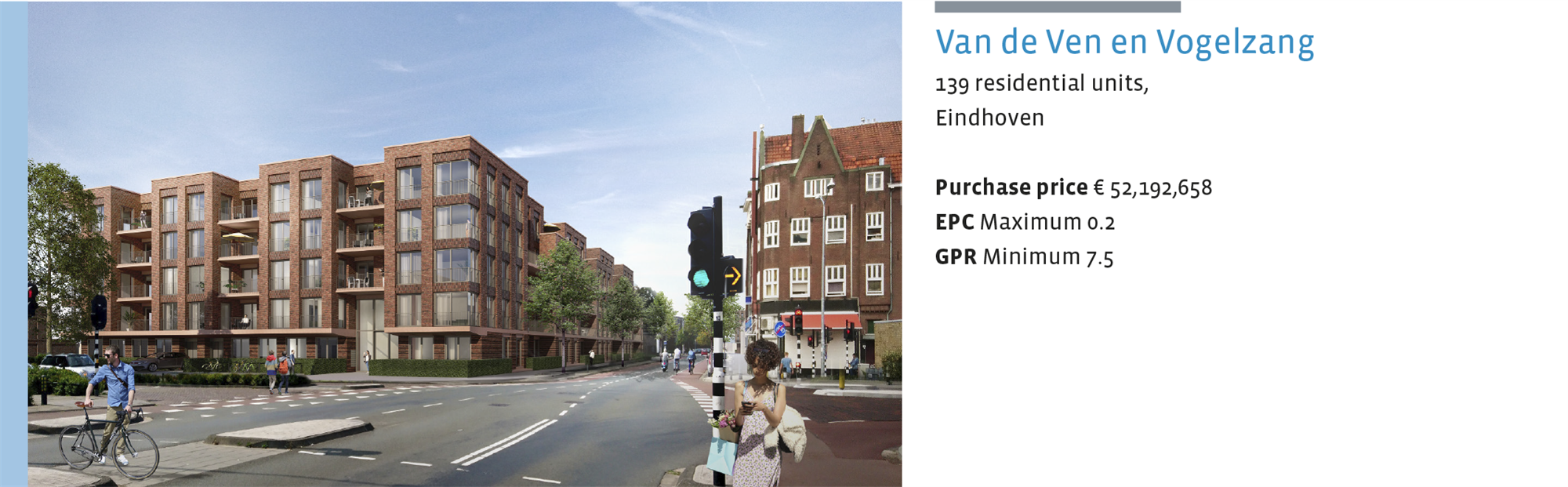

Van de Ven en Vogelzang, Eindhoven

Expected rental bandwidth € 997 - € 1,430 (price level 2022)

The De Gebroeders project is located on the border between the Philipsdorp and Vonderkwartier neighbourhoods in Eindhoven. The project comprises 139 apartments varying in size between 74 m² and 121 m², together with 139 parking spaces divided across two buildings. The buildings are around 1,200 metres apart, but are being treated as a single plan development with similar architecture, city planning design and range of homes. Delivery is scheduled for 2022.

NEXT, Eindhoven

Expected rental bandwidth € 1,039 - € 1,470 (price level 2022)

The NEXT project in Eindhoven is located at Strijp-S in Eindhoven. Strijp-S is the redevelopment location of the former Philips site on the edge of Eindhoven city centre. The project comprises a residential tower with 99 rental apartments of 65 m² to 109 m², 27 purpose-built parking places and 424 m² GLA of commercial space. A further 60 apartments are designated for sale to private buyers. An above-ground parking lot will be built behind the complex (between the residential tower and the railroad tracks) for use by both residents and visitors. Delivery is scheduled for 2022.

Properties added to the portfolio

In 2019, the Fund added a total of 1,187 apartments and 347 family homes to its portfolio. See below for a list of the new properties in the portfolio.

Property | City | No. of residential units |

|---|

Zijdebalen IV | Utrecht | 52 |

Frixos (De Werf F) | Amsterdam | 36 |

Glenlyon (De Werf G) | Amsterdam | 168 |

Frixos (De Werf F) COG | Amsterdam | 0 |

Glenlyon (De Werf G) COG | Amsterdam | 0 |

State I (Kop Weespertrekvaart) | Amsterdam | 160 |

Nieuw Nachtegaalplein II | Nijmegen | 38 |

Up Town | Rotterdam | 150 |

Explorer (De Werf E) | Amsterdam | 69 |

Explorer (De Werf E) COG | Amsterdam | 0 |

Kop van West | Purmerend | 74 |

Hof van Pampus | Hoofddorp | 74 |

Meierijlaan | Eindhoven | 24 |

KVL | Oisterwijk | 60 |

Tudorpark EGW | Hoofddorp | 98 |

Tudorpark MGW | Hoofddorp | 36 |

Welgelegen Park MGW | Apeldoorn | 31 |

Welgelegen Park EGW | Apeldoorn | 20 |

Oostduinlaan | s-Gravenhage | 146 |

Picuskadeblok | Eindhoven | 36 |

Haarzicht | Utrecht | 126 |

Rijswijk Buiten-Sion MGW | Rijswijk | 59 |

Zonnehoeve | Apeldoorn | 41 |

Velperparc | Arnhem | 36 |

Divestments

In 2019, the Fund divested properties for around € 83 million, comprising 437 family homes and 64 apartments. Furthermore, the Fund signed one sales agreement for 455 family homes and 120 apartments for € 150 million. Delivery will take place in 2020. As our acquisitions in 2019 were higher than plan, we increased our divestments slightly. The decision to sell residential complexes is largely driven by the returns they are expected to generate over the next ten years. Factors that lead to the decision to sell include the location, the product/market combination, the potential to increase the rents and the local rental market. Residential real estate is currently very much in demand among both domestic and foreign investors, and we are seeing high levels of interest in assets we put up for sale. So we see very few obstacles to the continued optimisation of our portfolio.

Properties sold

Following our annual hold-sell analysis, the Fund decided to sell the following properties:

Property | City | No. of residential units |

West Ede | Ede GLD | 116 |

Peelo I | Assen | 92 |

Hagerhof West | Venlo | 73 |

Hoogeveen | Hoogeveen | 64 |

Brouwerhof Zuid | Valkenswaard | 116 |

Tolberg | Roosendaal | 40 |

| | | |

*Mierlo Hout | Helmond | 41 |

*Dunantweg | Deurne | 26 |

*Watermolen | Roosendaal | 20 |

*Oranjelaan | Roermond | 87 |

*Dommelbergen II | Oosterhout NB | 32 |

*Craneveld | Venlo | 35 |

*Wasbeek | Sassenheim | 64 |

*Cauberg | Alphen aan den Rijn | 37 |

*Mercatorweg | Hoek van Holland | 33 |

*Heer Oudelands Ambacht II | Zwijndrecht | 38 |

*Maaskwadrant | Hoogvliet Rotterdam | 120 |

*Endenhout | Hoogvliet Rotterdam | 42 |

| | | |

* contract signed, delivery in Q1 2020 | | |